人傻钱多速来

评论

预留:挖矿

小朋友演示6卡经典版

骨灰级玩家12卡

工业级- Genesis

世界最大的云挖矿公司Genesis的老板的TED演讲,他的两大矿场,一个在上海,一个在冰岛。

他的演讲里有个十分悲情的人物,比特币刚出现的时候,这位爱好者用自己一台破笔记本电脑挖出了三万多个比特币,他的女朋友嫌他的电脑一直开着吵,不许他挖矿,矿也不挖了,电脑也扔掉了,一亿多美元就这样没有了。

悲情故事的标题我觉得应该定为<<论找旺夫女友的重要性>>。

评论

预留:ICO

https://www.bloomberg.com/news/a ... tal-currency-riches

Bankers Ditch Fat Salaries to Chase Digital Currency Riches

By Lulu Yilun Chen and Camila Russo

July 26, 2017, 7:00 AM GMT+10 July 26, 2017, 10:55 AM GMT+10

Richard Liu gave up a seven-figure salary this month to get into one of the hottest financial instruments around right now: initial coin offerings. The former China Renaissance deal-maker has since backed a clutch of cryptocoin sales that’ve raised millions -- sometimes in seconds -- often without a single product.

From Hong Kong and Beijing to London, accomplished financiers are abandoning lucrative careers to plunge into the murky world of ICOs, a way to amass quick money by selling digital tokens to investors sans banks or regulators. Cut out of the action, a growing cohort of banking professionals are instead applying their talents toward buying or hawking cryptocurrency.

They’re going in with eyes wide open. For Liu, who put together some of China’s biggest tech deals in his old job, the chance to shape the nascent arena outweighs the dangers of a market crash or crackdown. Loosely akin to IPOs, ICOs have raised millions from investors hoping to get in early on the next bitcoin or ether, and their unchecked growth over the past year is such that they’ve drawn comparisons to the first ill-fated dot-com boom. Yet with stratospheric bonuses largely a thing of the past, the allure of an incandescent new arena far from financial red-tape has proven irresistible to some.

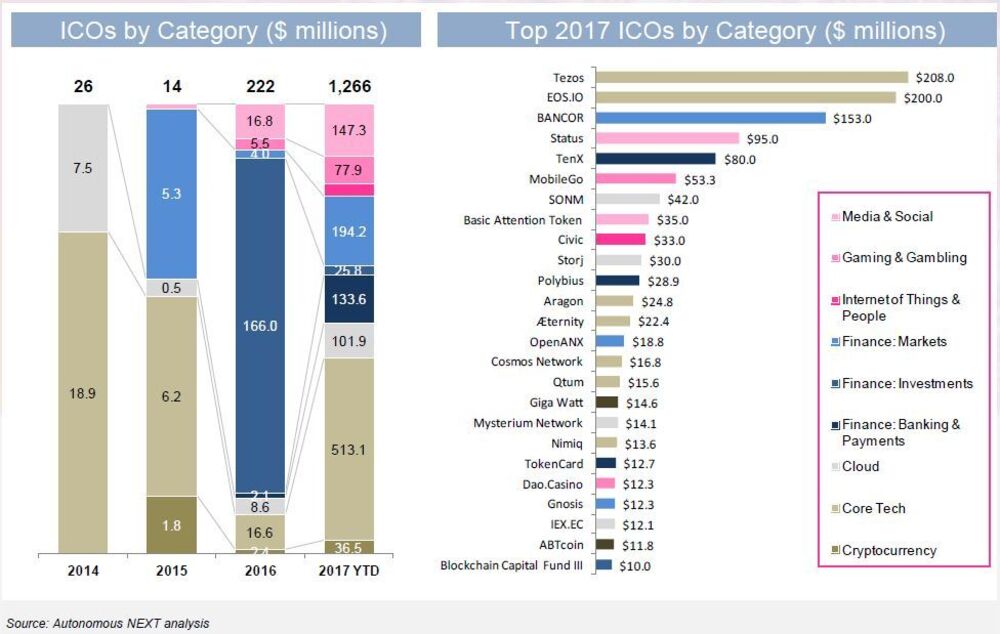

“Traditional investment banks and VCs need to monitor this space closely, it could become very big,” said the 30-year-old partner at $50 million hedge fund FBG Capital, which has backed about 20 ICOs. He’s off to a quick start, getting in on this year’s largest sale: Tezos, a smart contracts platform that raised $200 million to outstrip the average Hong Kong IPO size this year of around $31 million.

“Unlike the traditional financial sector, there are no ceilings or barriers. There’s so much to imagine,” he said.

Critics say many ICOs are built on little more than hyperactive imaginations. A cross between crowdfunding and an initial public offering, they involve the sale of virtual coins mostly based on the ethereum blockchain, similar to the technology that underpins bitcoin. But unlike a traditional IPO in which buyers get shares, getting behind a startup’s ICO nets you virtual tokens -- like mini-cryptocurrencies -- unique to the issuing company or its network. That means they grow in value only if the startup’s business or network proves viable, attracting more people and boosting liquidity.

That’s a big if, and the sheer profusion of untested concepts has spurred talk of a bubble. The U.S. Securities and Exchange Commission signaled greater scrutiny of the red-hot sector when it warned on Tuesday that ICOs may be considered securities, though it stopped short of suggesting a broader clampdown. The regulator however did reaffirm its focus on protecting investors: part of the appeal of ICOs lies in the fact that -- for now -- anyone with a bold idea can raise money from anybody.

At least 90 ICOs have taken place this year, raising more than $1 billion based on proposals from free wi-fi sharing to trading software without a single line of code. It’s already exceeded early-stage venture capital financing. With little more than an explanation of the ad-lite browser it envisioned, Brendan Eich’s Brave Software scored $35 million for its Basic Attention Token sale in under a minute in May.

“These ICOs are not selling shares, which means their investors will have to count on the promise and reliability of the founders,” said Beijing-based Chandler Guo, a bitcoin miner and angel investor who’s helped more than 20 ICOs list on cryptocurrency exchanges. So “I don’t invest in any projects unless I know where they live and their mother lives.”

Justin Short, who created electronic trading algorithms for Bank of America Corp. before launching trading-related startup Nous, is preparing to launch his own sale of digital tokens to bankroll what he calls cryptoasset portfolio management. A former Wall Street floor trader, he likens the advent of ICOs to an episode half a billion years ago when many of the planet’s life forms came into existence.

“It’s a Cambrian explosion of ideas. But that means you have to put in your work to figure out which one is even likely to work,” he said.

Cryptocoins bypass middlemen such as fee-absorbing banks and venture capital firms, and offer access to fast money. But that also means traditional checks and balances are absent. The key may be to recognize which tokens serve an essential purpose to the selling startup’s network, and thus will appreciate in value alongside rising adoption.

Former HSBC forex-trading architect Hugh Madden, currently Chief Technology Officer of Hong Kong-based ANX International, this month helped raise about $18.7 million for cryptocurrency exchange OAX. He likens ICO-token ownership to a football club membership. You don’t get special access but as the team gets better, more people become fans and the price goes up.

When a football club “builds more relationships with other clubs, gets more matches, and generally enjoys wider adoption, then more people want to be a part of it,” the 40-year-old said. “There is no limit to participants, but there is a limit to memberships that allow members to exert influence on the future direction of the club.”

With ICOs however, the true price of membership can be impossible to gauge. Prominent bitcoin developers including Peter Todd have pointed to coding flaws in projects. Trading platform CoinDash said hackers made off with $7 million during its ICO just this month. Hackers made off with nearly $40 million last week, stealing ICO funds from CoinDash, Swarm City, æternity, and others. And a significant number of ICOs have been underpinned by mere protocols -- operational frameworks with standard processes minus a business model.

“It’s very hard to value a protocol,” said Gavin Yeung, a former Hong Kong-based trader at Deutsche Bank AG who’s weighing an ICO for his cryptocurrency index trading platform Cryptomover. “The protocol only becomes valuable if the number of users increase exponentially on the network, so unless these protocols have substantial users or awareness, these projects could end up with zero value.”

The rush of speculators and get-rich-quick schemes in the space has both Yeung and Madden expecting more regulatory scrutiny. But the challenge is ICOs aren’t confined by geography. For example, OAX’s token attracted 4,400 backers across a dozen jurisdictions from China to Russia and the U.S. “It’s very hard for regulators to have an isolated policy response that’s happening on a global cross-border basis,” Madden said.

Interest in ICOs remains sky-high. Ron Chernesky started his career as a trader on Wall Street 10 years ago, first on a trading floor and then running trading platform InvestFeed Inc. He’s now in the process of replacing U.S. equities trading on his platform with digital currency trading, and planned to conduct his own ICO to raise 28,000 ether -- worth roughly $6 million at current prices.

“We’re completely ditching the model that we’ve been doing for the past three years and now we’re looking at cryptocurrency,” the 38-year-old said. “This is long term for us, we see this as the new gateway to the millennial way of investing and where everything is going from here.”

Perhaps. Liu, the ex-China Renaissance executive, compares the ICO market to the first internet boom and bust, when startups from Webvan to Pets.com imploded and investors’ money went up in smoke. Yet it’s in part the opportunity to carve out a niche away from monolithic banking bureaucracy that’s lured him to this space.

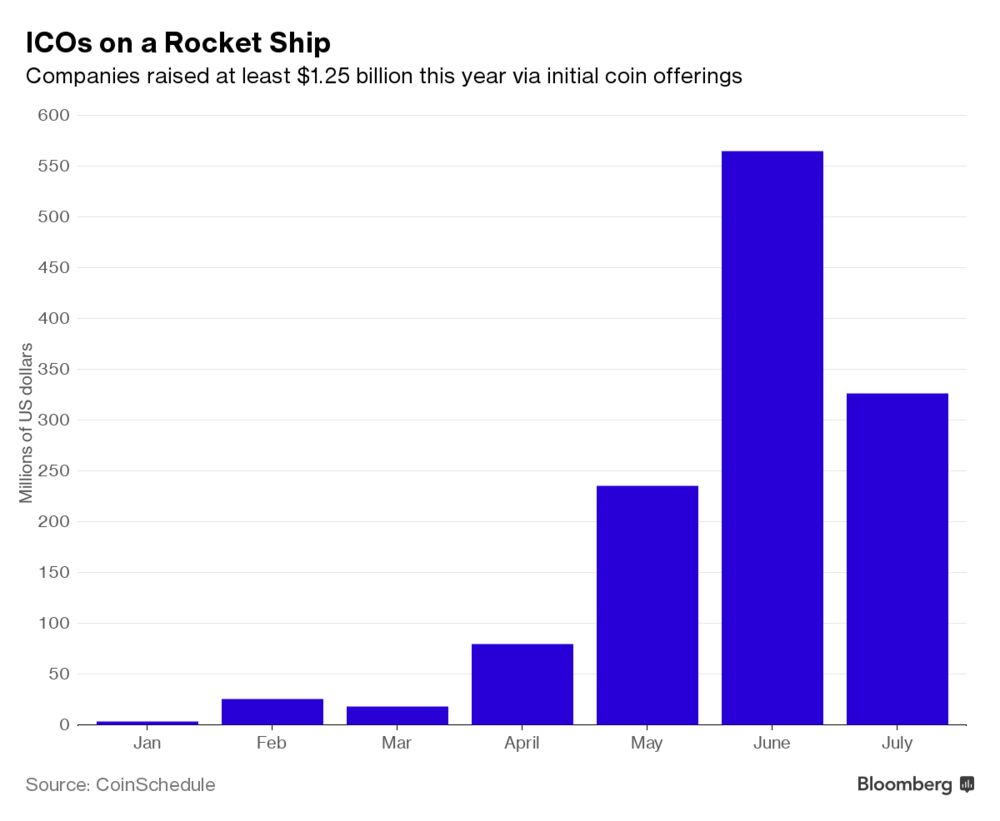

“You want to be on a rocket ship,” Liu said. “If you join early, then every day you’re making history.”

— With assistance by Yuji Nakamura

评论

预留:炒币

http://invezz.com/pages/ethereum-overtake-bitcoin

http://mashable.com/2017/07/26/b ... o-buy/#txv8QiW0DOqR

评论

预留:Smart Contract over EVM

评论

预留:日常生活中消费使用以太币

https://www.bloomberg.com/news/a ... oin-into-real-world

Singapore Startup Takes Bitcoin Into Real World With Visa

By Krystal Chia and Sterling Wong

July 24, 2017, 7:00 AM GMT+10 July 24, 2017, 1:46 PM GMT+10

A recurring challenge for bitcoin and other cryptocurrencies is how to make them work in the real world. A Singapore-based startup says the answer is its Visa card.

TenX is pitching its debit card as an instant converter of multiple digital currencies into fiat money: the dollars, yen and euros that power most everyday commerce. The company said it takes a 2 percent cut from each transaction and has received orders for more than 10,000 cards. While transactions are capped at $2,000 a year, users can apply to increase the limit if they undergo identify verification procedures.

Tenx’s bid to make digital currencies easier to spend comes amid massive volatility and infighting within the cryptocurrency community. Bitcoin, the most popular, slumped after reaching a record in June amid concerns about a split in two, only to recover as fears faded. The company has built an app that serves as a digital wallet connected to the Visa card so that when it’s swiped at a cafe or restaurant, the merchant is paid in local currency and the users’ crypto account is debited.

“You’re mixing two worlds that are night and day,” co-founder Julian Hosp said in an interview. “When the user spends the cryptocurrency, we have to instantly switch these currencies to fiat and pay to Visa straight away. It’s a lot of pathways."

Hosp said transactions are processed immediately and it doesn’t impose any charges on top of the conversion fee that is set by cryptocurrency exchanges, which typically is 0.15 to 0.2 percent. The card now supports eight digital currencies, including the lesser-known dash and augur, and aims to offer about 11 of them by the end of the year.

TenX currently processes about $100,000 of transactions a month. By the end of 2018, it’s targeting $100 million in monthly transactions and a million users.

TenX has an advantage in moving early, but the startup can expect competition in the future from major financial institutions and venture capitalists with deeper pockets and direct access to clients and databases, said Mati Greenspan, a Tel Aviv, Israel-based analyst at social trading platform eToro.

“It’s an incredible concept,” said Greenspan. “At the end of the day, it’s going to depend a lot on customer relations. Are they meeting the customers’ expectations? Can somebody else do it better?”

TenX’s efforts to make digital currencies spendable come as it joined the many blockchain-based startups taking advantage of initial coin offerings. ICOs are a cross between crowdfunding and an initial public offering that firms use to raise funds by issuing digital tokens rather than stock.

In its token sale last month, TenX raised $80 million with about half to be used to expand operations while the rest will provide liquidity for a cryptocurrency exchange in the works, said Hosp.

The company had previously raised $120,000 from angel investors and $1 million in a seed round led by venture capital firm Fenbushi Capital, which lists Ethereum’s co-founder, Vitalik Buterin, as a general partner. TenX isn’t expecting to become profitable in the next two years as it focuses on expanding services.

“One thing we want to offer in the end, is that you can switch cryptocurrencies within the app,” said Hosp. “If we do this, we can become the market maker, which can bring in a lot of revenue.”

比特币和其他加密数字货币主流化面临的挑战是如何让在现实世界中使用。新加坡一家初创公司TenX表示, 答案是visa 卡。

TenX 发行的Visa借记卡可以把多种数字货币的即时转换为各国法定货币,例如电子商务中最常用美元, 日元和欧元。该公司表示, 每笔交易需要2%的手续费, 一开始接受申请,就已经收到超过1万张卡的订单。一开始有每年2000美元消费上限, 但如果用户通过身份验证, 则可以申请增加使用额度。

正当数字货币存在巨大价格波动和社群内存在分歧与争议之际,TenX的创新使数字货币更容易消费。最出名的比特币在今年六月创下历史新高后,因市场担心比特币的分裂而暴跌, ,目前市场恐惧消退,价格恢复。TenX已经开发好一个连接Visa 卡的数字钱包应用程序, 这样在咖啡馆或餐馆刷Visa卡, 商家会收到当地货币, 用户则支付加密数字货币。

"你把白天和黑夜两个世界融合在一起" 创始人朱利安.豪斯普在接受采访时说,"当用户用加密数字货币进行消费, 我们必须立即将这些货币转换为法定货币支付给Visa。这一过程要经过不少付费通道。(译者注:白天黑夜的比喻暗指比特币是暗网的支付货币)

豪斯普说, 交易是即时处理的, 除了加密数字货币交易所通常收取的千分之一点五到千分之二的手续费, 不额外收转换费。该Visa卡目前支持八中加密数字货币, 包括鲜为人知的Dash和Augur,计划在今年年底之前币种增加到11个。

TenX 目前处理每月约10万美元的交易。到2018年底, 目标达到每月1亿美元的交易和100万用户。

社交交易平台电子牛eToro 的一名位于以色列特拉维夫分析员马提.格林斯潘评论说, TenX具有先发优势, 但在未来可能会面临来自主要金融机构和风险投资家的竞争, 他们资本更雄厚,还能够直接接触客户和数据库。

"这是一个非常棒的理念," 格林斯潘说。"但最终的结果,很大程度上还是取决于客户关系。服务是否满足客户的期望?竞争对手会不会做得更好?

TenX 的努力, 实现了加密数字货币可支付。 该公司也加入了许多 基于区块链的初创企业进行首次发币融资 (ICO)。ICO是众筹与首次公开募股的融合。公司通过发行数字令牌取代股票来筹集资金。在上个月的ICO中, TenX 筹集了8000万美元, 约有一半用于扩大业务, 其余部分将为一个加密数字货币交易所提供流动性。

该公司此前曾向天使投资人募集了12万美元, 并从风险投资公司 Fenbushi 资本领导下从种子轮中募得100万美元资金,并列出以太坊Ethereum的创始人 Vitalik Buterin 作为一般合伙人之一。TenX 不打算在未来两年内盈利, 而将专注于扩大服务范围。

"我们最终要提供的服务是, 您可以在 App 中转换加密数字货币," 豪斯普说, "如果我们能够做到, 我们就可以成为市场庄家, 这会带来很多收入."

评论

这里的傻子输得差不多了,可能要换个地方去找了

评论

哈哈哈哈

评论

前期空澳元的投机者在0.80附近可能会被大鳄反复绞杀,血流成河,最后因失血过多致死,非常残忍

貌似越是“懂”的多的死得越惨

评论

RBA扭捏,所以很可能要波动一段时间

评论

三期叠加:

货币收缩期,美联储今年九月第一个开始施行

政策巨变期,美国中国都正在进行国家级别的转型

第四次工业革命期

小百姓懂个啥,还炒

评论

三期叠加,机会难得啊,发财就靠这个了!

评论

今年以来美元指数下跌了8% 仅上个月以来就下跌了4% 明显在加速 底在何处无人知晓 目测一众炒外汇的韮莱被割的只剩下根 选择继续战斗下去的很可能被连根拔掉

评论

歪楼啦。

以太讨论帖,不是炒汇讨论帖。

评论

有算法,为何不能自己建一个新的数字货币?

评论

没歪,说的就是反对炒,炒你这个币死的更惨

评论

炒汇还要懂点宏观经济的吧,几个pip的动,波动个4%好像天要塌下来一样。

炒币纯粹是赌大小,24小时内波动个40%是常态,几小时波动300000%都有过,完全两样好么?

评论

哥,你和吓前辈计较就是你的错了,和他计较完全浪费时间。

你看看他都是哪路的troll.

评论

那你用电脑的时候顺便挖,不额外多花电费,早晚能把显卡钱赚出来。

评论

唯一能想到的就是凑点钱,然后去塔斯马尼亚挖矿了。

评论

思路要拓宽,不要光想着水电,只要电便宜就行。

比如说,大学宿舍里,或者房东包电费的,屋里放两台矿机,房租不就有了;

房间太小不要心太黑啊,我看论坛上说有过一个大学生,卧室里摆满了矿机,最后散热不好中暑了。

还有更高端,把热能利用上输送到暖棚的:

http://heavy.com/marijuana/2017/ ... in-mining-hardware/

家里有太阳能的,挖矿可以更快的收回安装成本。

家住维州的,去相扑电力签预付一年电费随便用电的合同,家里就可以摆满矿机,两个星期挣出一年电费,三到六个月回本,剩下是纯利润。

评论

我是不迷这些啊。能力有限,就是纯粹当个实物在尝试去了解。

做好本职工作,工作做的好,赚钱就不少。

我这样的,一年有10w刀收入就可以了。多赚多亏。XD

评论

悉尼电费多钱啊?

评论

这就是我开始有点讨厌这个虚拟货币的原因。

评论

坦率地说,电费都会影响效益,那回报低的可怜啊。

评论

奇怪为什么华人媒体竟被些利益集团坏人掌握,整天搞些忽悠普通百姓钱财的勾当,坏透了

评论

浪费电力资源在这种虚拟的东西上,真浪费

评论

还不如去薪赌场 玩百家乐呢。。。至少还有50%左右的机会赢

评论

这个很难讲,食物链高端的利润率还是很高的,先进省电效率高的设备就贵,还买不到。

比如这台矿机,如果能第一时间拿到货,不到一个星期就能回本。

但是等一两个月拿到矿机,军备竞赛升级以后,就可能要几个月才能回本了。

这就是为什么大矿头愿意包一架747从美国运显卡到中国,就为了抢出十天挖矿时间。

http://www.businessinsider.com/c ... ng-747s-2017-7?IR=T

而且那些有硬件研发能力的矿头,都是最先进的矿机给自己用,升级下一代了,再把上一代拿出来卖钱。

澳洲中文论坛热点

- 悉尼部份城铁将封闭一年,华人区受影响!只能乘巴士(组图)

- 据《逐日电讯报》报导,从明年年中开始,因为从Bankstown和Sydenham的城铁将因Metro South West革新名目而

- 联邦政客们具有多少房产?

- 据本月早些时分报导,绿党副首领、参议员Mehreen Faruqi已获准在Port Macquarie联系其房产并建造三栋投资联